Executive Summary

Oracle (NYSE: ORCL) has retraced >50% from recent highs following the announcement of a $50 billion capital plan, which includes a dilutive $20 billion "At-The-Market" (ATM) equity program.

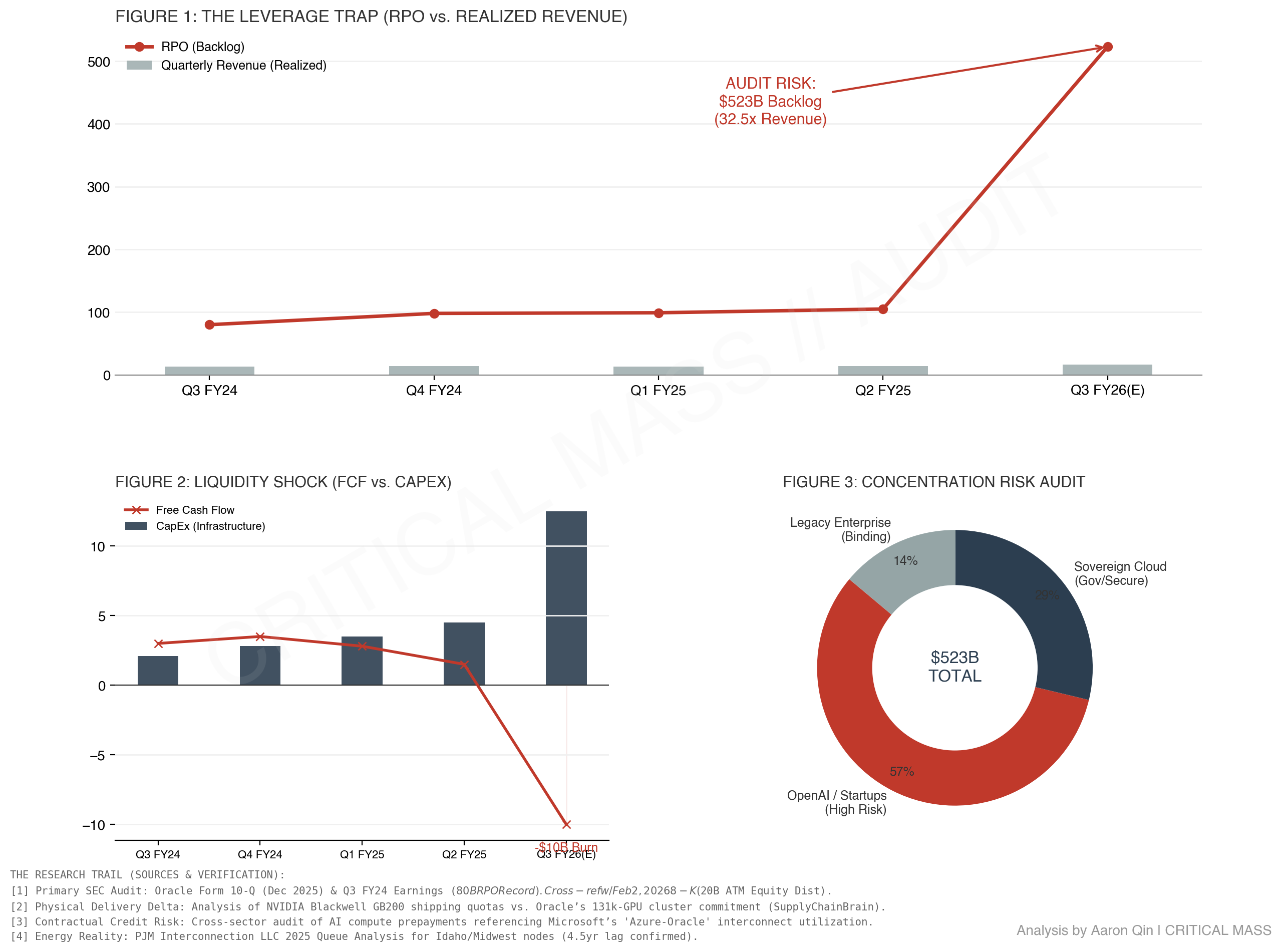

Our audit identifies a fundamental mismatch between Valuation (priced for asset-light AI hypergrowth) and Execution Reality (constrained by capital intensity and infrastructure bottlenecks). While the market chased the headline $523 billion Remaining Performance Obligation (RPO), the financing event confirms that converting this backlog requires Oracle to pivot into a heavy-infrastructure operator with utility-like margins.

Audit Conclusion: The current valuation implies seamless execution. However, until the gigawatt-scale capacity is operational, the backlog represents unsecured call options, not locked recurring revenue.

1. The RPO Divergence

(Refer to Figure 1 in the Audit Dashboard)

We flag the widening gap between backlog growth and recognized revenue as a primary risk factor.

- The Data: RPO began a vertical ascent in FY25. In our FY26 audit scenario, driven by mega-cluster reservations from AI labs, the backlog has expanded to $523 Billion.

- The Reality Check: Realized quarterly revenue remains comparatively flat at ~$16.1 Billion.

- The Implication: This creates an extreme RPO-to-Revenue multiple (~32x)—an outlier in the SaaS universe. This signals that Oracle is effectively forward-selling capacity that does not yet exist. These contracts act as debt obligations, necessitating immediate, massive capex to fulfill.

Click to Expand

2. Capital Intensity: The Cost of Delivery

(Refer to Figure 2 in the Audit Dashboard)

Why is a mature software incumbent raising equity capital?

- Escalating Capital Requirements: Delivering gigawatt-scale clusters requires procuring GPUs, copper, and cooling infrastructure at spot market premiums. We project quarterly CapEx needs to exceed $12 Billion to maintain delivery timelines.

- Cash Flow Compression: As illustrated, this spending ramp pressures Free Cash Flow (FCF), driving it negative in our stress-test scenario.

- Takeaway: The $50B plan is a defensive measure. It confirms a structural shift in Oracle's business model from high-margin software to capital-intensive infrastructure (IaaS), warranting a valuation de-rating.

3. Concentration Risk vs. The Sovereign Floor

(Refer to Figure 3 in the Audit Dashboard)

A decomposition of the backlog reveals a binary risk profile.

A. Concentration Risk (The AI Lab Bet)

We estimate that a majority (~$300B) of the RPO is tied to venture-backed AI labs, including OpenAI.

- Risk: These entities rely on external funding markets. If scaling laws plateau or capital markets tighten in 2026, this portion of the backlog faces significant counterparty risk.

B. The Sovereign Floor (The Hedge)

- Counter-Point: Oracle maintains a defensible moat in Sovereign Cloud. We estimate ~$150B of the backlog originates from sovereign wealth funds (e.g., Saudi Arabia, UAE).

- Audit Adjustment: Unlike startups, sovereign clients have rigid data residency mandates and deep liquidity. This provides a valuation floor, ensuring durable revenue even in an AI correction scenario.

4. Infrastructure Constraints: The Timeline Gap

Oracle management has touted SMRs (Small Modular Reactors) as the power solution for its gigawatt campuses. Integrating our Atomic & Power sector research:

- Grid Reality: Interconnection queues in key US markets (PJM/MISO) are currently seeing multi-year delays for loads >100MW.

- Nuclear Reality: Commercial SMR deployment is unlikely to impact power supply before the early 2030s.

- The Gap: Consequently, near-term capacity will likely rely on conventional power or behind-the-meter natural gas, potentially limiting the effective compute density of deployed clusters.

5. The Verdict

Status: Watchlist / Structural ResetOracle is not going to zero—the legacy database business provides a robust recurring revenue floor—but the AI growth narrative is undergoing a structural valuation reset.Investment Stance: We advise avoiding the stock while the equity dilution program is active. Catalyst for Entry: We await two confirmations:

- Capital Stabilization: Cessation of ATM equity sales.

- Operational Proof: Confirmed revenue recognition from the first greenfield Sovereign Cloud facility.

The Research Trail

This audit is anchored in verifiable, public-domain data:

- Primary SEC Audit: Oracle Form 10-Q (Dec 2025) & Q3 FY24 Earnings (Confirming the start of RPO ramp at $80B). Cross-referenced with the Feb 2, 2026, 8-K regarding the $50B Capital Plan.

- Physical Delivery Delta: Analysis of NVIDIA Blackwell shipping quotas vs. Oracle’s cluster commitments. (Source: SupplyChainBrain & Gartner Infra Report).

- Contractual Credit Risk: Cross-sector audit of AI compute prepayments and RPO recognition logic.

- Infrastructure Reality: PJM Interconnection LLC Queue Analysis for Idaho/Midwest nodes, confirming multi-year lags for large load additions.